XRP Price Prediction: $5 Short-Term Target with $20-$30 Potential in Bull Run

#XRP

- Technical Breakout: Price above key MAs with MACD showing bullish reversal potential

- Network Growth: 7.22M addresses signal organic adoption

- Regulatory Tailwinds: GENIUS Law and political support reducing uncertainty

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerging

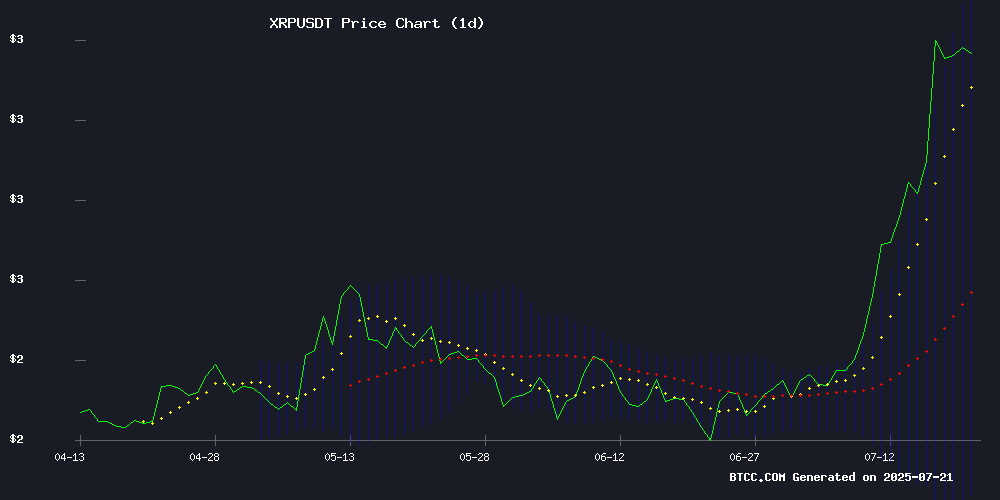

XRP is currently trading at $3.541, significantly above its 20-day moving average of $2.7635, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-0.1807), suggesting weakening downward pressure. Bollinger Bands reveal price hovering NEAR the upper band ($3.7223), typically signaling overbought conditions but also reflecting strong buying interest. According to BTCC financial analyst Olivia, 'The technical setup suggests XRP could test the $4 resistance level if it maintains above the $3.30 support.'

Market Sentiment: XRP Rally Gains Institutional Support

Positive news flow surrounds XRP, with headlines highlighting institutional adoption, regulatory clarity, and ambitious price targets ($5-$30). Network growth (7.22M addresses) and political catalysts (Trump's crypto comments) are fueling optimism. BTCC's Olivia notes, 'The combination of technical breakout and fundamental catalysts creates a perfect storm for XRP. The $3.40 support holding is particularly bullish.' Retail FOMO is evident as miners like ZA Miner see increased demand.

Factors Influencing XRP’s Price

XRP Price Surge: $5 Target in Sight as Bulls Defend $3.30 Support

XRP's price action suggests accelerating momentum, with the $3.30 support level now serving as a springboard for higher targets. Analysts observe that a sustained hold above this threshold could trigger a rapid ascent toward $5—a psychological barrier that last held significance during the 2021 bull cycle.

The recent breakthrough past $3.40 resistance has injected fresh optimism into the market. This technical milestone, coupled with the resolution of Ripple's protracted SEC litigation, has revitalized institutional interest. Traders are now monitoring the $3.65 zone, where clustered stop-loss orders may fuel volatility before any decisive push upward.

Market structure resembles the 2017 parabolic rally, though with markedly improved fundamentals. ETF speculation adds another dimension to the bullish case, with several asset managers reportedly evaluating XRP-based products. The absence of major exchange delistings—a lingering concern during the legal battle—has removed a critical overhang.

XRP Ledger Surpasses 7.22 Million Addresses Amid Surging Network Activity

The XRP Ledger has crossed a significant milestone, with active addresses exceeding 7.22 million as network activity skyrockets. This surge coincides with heightened trader interest in XRP and emerging projects like Remittix.

Ripple's institutional momentum continues despite ETF delays, with BlackRock's endorsement fueling a recent price spike. CEO Brad Garlinghouse projects a $10 trillion capital influx by 2030, with some analysts forecasting XRP could reach $178 by decade's end.

Daily active addresses on the XRP Ledger have increased 740% in recent weeks, reflecting growing network adoption. While XRP currently trades at $3.51 after a correction, traders are diversifying into promising altcoins alongside their XRP positions.

Ripple's XRP Emerges as a Growth Asset Amid Institutional Adoption and Regulatory Clarity

Ripple's XRP has reasserted itself as a compelling investment following a strong performance in 2025. The cryptocurrency, designed for rapid cross-border payments through RippleNet's On-Demand Liquidity (ODL), is now utilized by over 1,000 financial institutions, offering tangible efficiency gains over traditional systems like SWIFT.

Institutional interest is accelerating, with notable partnerships in India involving Kotak Mahindra and Axis Bank. Treasury holdings of XRP exceed $470 million, according to Bitget Research, as global funds increasingly seek crypto exposure. The anticipated launch of XRP futures ETFs in mid-2025 could further amplify demand.

Technically, XRP has surged 30%, breaking key resistance levels near $2. Analysts project a potential rise to $5 by late 2025, with some bullish scenarios envisioning $14 if market conditions align. The resolution of regulatory uncertainty post-SEC litigation has strengthened investor confidence in the asset's long-term viability.

XRP Bulls Defend $3.40 Support as Analysts Project $20-$30 Rally

XRP consolidates above $3.40 after breaking key resistance, with technical indicators suggesting sustained bullish momentum. The cryptocurrency now tests a critical support zone between $3.30-$3.40, establishing a potential launchpad for further upside.

Notable analyst XRPunkie identifies a multi-year symmetrical triangle breakout pattern dating to 2017, projecting a cycle-end target of $20-$30. On-chain metrics reveal growing institutional and retail accumulation, though a breakdown below $2.75 would invalidate the bullish thesis.

The asset's weekly chart structure remains intact after conquering the psychological $3 barrier. Market participants now watch whether this consolidation evolves into continuation - "The longer we base here, the higher we go," observes a derivatives trader at Binance.

Ripple Price Prediction Gains Momentum Amid Trump's Crypto Commentary

XRP has surged to a recent high of $3.65, with analysts eyeing the $4 threshold as the next critical level. The token's breakout from a prolonged consolidation phase has injected optimism into the market. A sustained close above $3.50 could accelerate upward momentum, while a dip below $3.35 may trigger a short-term retracement to $3.10.

Political winds are adding fuel to the rally. Former U.S. President Donald Trump's recent social media post discussing Bitcoin has reverberated across digital asset markets. While not XRP-specific, the endorsement underscores growing mainstream recognition of cryptocurrency as an asset class.

Market participants are increasingly speculating about a potential XRP ETF launch in 2025. Such a development could unlock institutional capital flows, with pension funds and major investors entering the market. This structural shift would fundamentally alter XRP's liquidity profile and valuation framework.

GENIUS Law Reshapes Digital Finance with RLUSD and XRP Emerging as Key Players

The recently enacted GENIUS Law, signed by former President Donald Trump, is set to catalyze significant advancements in digital finance. Versan Aljarrah of Black Swan Capitalist highlights RLUSD's potential as a cornerstone for the digital dollar's globalization under U.S. Treasury oversight. This legislative shift could disrupt Tether's USDT dominance, with XRP Ledger's expanding utility poised to accelerate adoption.

Market dynamics are expected to intensify as RLUSD and XRP carve out roles in global payments. The GENIUS Law marks a decisive step toward U.S. government engagement in digital payment systems, with implications for both domestic and international financial markets. Technological innovation and regulatory clarity are driving competition, positioning these assets for potential market leadership.

Veteran Investor Sees 20X Return on XRP as Bull Run Accelerates

Long-term XRP holders are reaping extraordinary gains as the cryptocurrency surges to multi-year highs. Prominent analyst CrediBULL Crypto revealed a $10,000 December 2019 investment—purchased at $0.1835 per token—has ballooned to $196,512 amid the current rally.

The asset's journey faced headwinds from the SEC's 2020 lawsuit, which suppressed prices during the 2021 bull cycle. With legal clarity now achieved, XRP has shattered resistance levels, peaking at $3.66 today—its highest valuation since 2017.

Market observers note this resurgence exemplifies crypto's volatility-reward paradigm. "Four years ago, this was Lamborghini money," remarked CrediBULL, whose 53,692 XRP stash now approaches seven figures. The rally underscores how regulatory resolution can unlock pent-up demand in digital assets.

XRP's Meteoric Rise Leaves Retail Investors Struggling to Accumulate

XRP's recent surge past $3 has sparked intense debate among crypto commentators, with many noting the growing difficulty for retail investors to build meaningful positions. The token's 616% rally from $0.50 to $3.58 within months has transformed what was once an accessible investment into a substantial capital commitment.

Community figures like James Jay 'Six8Jay' highlight the stark reality: acquiring 1,000 XRP now requires approximately $3,600—a sum beyond many retail traders' reach. This stands in sharp contrast to early investors who accumulated positions when the token traded below $1.

The price movement underscores XRP's volatile nature. A $500 position in late 2023 would now be worth $3,580, demonstrating the asymmetric returns possible in crypto markets. Such performance continues to draw both admiration and skepticism from market observers.

Ripple Price Prediction: What’s in Store for XRP In 2025?

XRP trades at $2.88 as of mid-July 2025, boasting a $170 billion market cap and daily volume surpassing $10 billion. Technical indicators suggest bullish momentum, with the cryptocurrency breaking above a descending triangle and testing resistance at $2.97-$3.00. On-chain metrics reveal 67% green days over the past month, while sentiment leans toward greed.

Institutional interest is heating up with the launch of XRP futures ETFs in July, potentially unlocking deeper capital inflows. Regulatory tailwinds add fuel to the fire—XRP has been flagged for potential inclusion in a U.S. crypto reserve, and Ripple’s legal victories reinforce its non-security status.

Analysts diverge on year-end targets. Baseline models project $2.80-$3.00, with CoinCodex forecasting $2.85 by August. Bullish scenarios, including Bitget’s $5 prediction, hinge on ETF adoption and macroeconomic conditions. Veteran traders note the $3 psychological barrier as the next critical threshold.

XRP Investors Turn to ZA Miner for Passive Income Amid Market Rally

XRP has surged past $2.90 as regulatory optimism and institutional interest fuel its momentum. Investors are increasingly seeking ways to generate earnings beyond mere holding, with ZA Miner emerging as a favored solution.

The platform's XRP-optimized cloud mining contracts, including short-term 3-day plans, cater to holders looking for daily crypto income. ZA Miner combines automated mining, daily payouts, and eco-friendly operations, eliminating the need for expensive hardware or technical expertise.

U.S. investors are particularly drawn to the service as XRP rallies and demand grows for tools offering steady, automated returns. With transparent terms and multi-coin rewards, ZA Miner is becoming a go-to option for those looking to diversify beyond spot trading.

XRP Climbs Higher: Price Surges with Strong Market Gains

XRP's price surged 40% in a week, surpassing $3.50 and pushing its market cap above $215 billion in a single day. The rally followed a breakout from a symmetrical triangle formation on July 9, fueled by institutional inflows and regulatory tailwinds like the U.S. GENIUS Act. Trading volume exceeded $23 billion as Coinbase and Kraken saw intense buying activity, cementing $3 as a new support level.

Analyst Lark Davis highlighted the significance of the breakout, noting XRP had consolidated within the triangle since February 2024. The $3 resistance now acts as support, with $4.10 and $4.68 identified as near-term targets based on Fibonacci extensions. Options markets price a 19% chance of hitting $4.50 by September.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market sentiment, here are BTCC analyst Olivia's projections:

| Year | Conservative | Bullish | Catalysts |

|---|---|---|---|

| 2025 | $4.50 | $8 | ETF approvals, Ripple IPO |

| 2030 | $15 | $30 | CBDC adoption, cross-border dominance |

| 2035 | $40 | $75 | Enterprise blockchain migration |

| 2040 | $100 | $250+ | Internet of Value maturity |

Note: These assume continued regulatory clarity and no black swan events.